American stock markets fell on Wednesday, caused by investors' reaction to the published minutes of the latest Federal Reserve meeting. At the same time, Nvidia shares rose sharply, rising 6% in after-hours trading after announcing earnings that beat analysts' expectations.

The announcement also boosted share prices of other companies in the chip manufacturing sector. Investors' attention has been focused on Nvidia's (NVDA.O) ability to meet strong first-quarter guidance and the potential to sustain growth in artificial intelligence stocks.

Nvidia shares, which ended the trading day lower, are up about 90% this year, following an impressive 240% gain in 2023.

"The market is looking for confirmation from Nvidia that they are able to maintain leadership despite their current successes... and what will happen to their strategic vision in the future and how they justify current estimates of their value," commented Megan Horneman, chief investment officer at Verdance Capital Advisors in Hunt Valley, Maryland.

"The most important thing is company valuations. Regardless of how the market reacts to the news, we must look closely at the financial statements and valuations offered for these companies' shares to understand how overvalued they may be," she added.

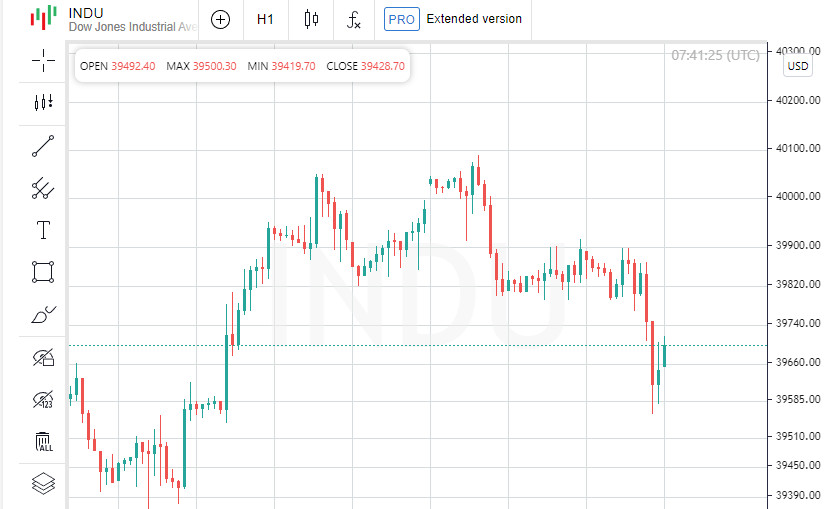

The Dow Jones Industrial Average .DJI lost 201.95 points, or 0.51%, to close at 39,671.04. The S&P 500 Index (.SPX) was down 14.40 points, or 0.27%, at 5,307.01. And the Nasdaq Composite Index .IXIC fell 31.08 points, or 0.18%, to finish the day at 16,801.54.

Stocks fluctuated throughout most of the trading session, but lost ground after the release of Federal Reserve meeting minutes revealed that central bankers still expect inflation to slow but admit it will be a long process, prompting disappointment due to latest inflation data.

The Fed's meeting, held from April 30 to May 1, followed a quarter of stable inflation but came ahead of later data indicating a potential easing in price pressures.

Stocks hit record highs this month, thanks in part to optimism in artificial intelligence, a strong earnings season and renewed expectations of a Fed rate cut this year.

Analysts expect the S&P 500 to remain near current levels of around 5,302 by year's end, but caution that significant gains in the index could lead to a correction in the coming months.

According to CME's FedWatch Tool, the likelihood of the Fed cutting rates by 25 basis points by the September meeting is estimated by markets at 59%, down from the previous level of 65.7%.

Shares of Analog Devices (ADI.O) rose 10.86% after announcing it expected third-quarter revenue to beat estimates.

The energy sector (.SPNY) was the worst performer, down 1.83%, as oil prices continued to decline for a third straight session.

Retail chain Target (TGT.N) shares fell 8.03% as its quarterly earnings and guidance for the current quarter fell below expectations.

While TJ Maxx parent TJX Companies (TJX.N) shares rose 3.5% on improved full-year profit forecasts.

Decliners outnumbered advancers by a 2.75-to-1 ratio on the New York Stock Exchange and 1.5-to-1 on the Nasdaq.

Mixed quarterly results from Target (TGT.N) and TJX (TJX.N) sparked discussions about the stability of US consumer activity.

Nvidia's upcoming quarterly report presents a new test for the US stock rally, which is heavily dependent on the outlook for artificial intelligence technology.

Investor sentiment has strengthened, according to Bassuk: "The market as a whole, the semiconductor sector and especially Nvidia, may have grown too fast and too much. We believe there is excessive hype around Nvidia and investors should approach their stock purchases with greater caution."

Statistics showed that the volume of real estate sales in the United States was below experts' expectations. At the same time, unexpectedly high core inflation figures in the UK have led investors to abandon bets on a possible interest rate cut by the Bank of England next month.

British Prime Minister Rishi Sunak announced elections on July 4. His Conservative Party is expected to concede to the Labor Party.

"Sunak is probably counting on a surprise effect... but this is unlikely to have much impact on markets," said Jane Foley, head of currency strategy at Rabobank in London. "It doesn't change the fact that Labor is 20 points ahead in the polls."

European shares retreated on reports of high inflation in the UK and news that China could impose tariffs on imported cars.

The pan-European STOXX 600 Index (.STOXX) was down 0.34% and the MSCI Global Share Index (.MIWD00000PUS) was down 0.39%.

Emerging market shares rose 0.12%. MSCI's broad index of Asia-Pacific shares outside Japan .MIAPJ0000PUS ended the session 0.31% higher, while Japan's Nikkei .N225 fell 0.85%.

The 10-year US Treasury yield rose from session lows following the release of Fed minutes.

At the last meeting, the 10-year Treasury note fell 4/32 in price, yielding 4.4276%, up from 4.414% at the end of the previous day.

The price of the 30-year US Treasury note rose to 4.5443% after rising 5/32 from 4.554% recorded Tuesday evening.

The US dollar strengthened against major world currencies. The dollar index (.DXY) rose 0.26%, while the euro weakened 0.29% to $1.0823.

The Japanese yen lost 0.39% to trade at 156.78 per dollar. The British pound was up 0.05% on the day, trading at $1.2713.

Oil prices extended their decline for a third straight day amid concerns that the US Federal Reserve's tight monetary policy could dampen demand.

The price of US WTI crude oil fell by 1.39%, reaching $77.57 per barrel, while Brent crude oil traded at $81.90 per barrel, down 1.18% from the previous value.

Gold prices also fell, moving away from recent record highs. The spot gold price fell 1.8% to $2,379.22 an ounce.