*) see also: InstaForex Trading Indicators for XAU/USD

However, gold is also not showing confidence or a desire among buyers to push prices above the resistance zone of 5000.00 – 5050.00. Nevertheless, against the backdrop of a weakening US dollar, expectations of Federal Reserve interest rate cuts, and sustained demand from central banks, the gold market remains in the spotlight for investors. The XAU/USD pair is consolidating at high levels, balancing between supportive fundamental factors and increased interest in risk assets.

Current Situation with Gold and Prospects for the Near Future

As we noted, there is currently no confident upward momentum — the market is in a state of consolidation. On the one hand, the weakening dollar and expectations of a softer US monetary policy support demand for the precious metal. On the other hand, positive sentiment in the stock markets limits gold's growth as a safe-haven asset. Additional support for prices comes from stable demand from central banks, primarily China, which continues to increase its gold reserves.

Federal Reserve Policy and Rate Cut Expectations

The ultimatum to the new candidate for the Federal Reserve chair, Kevin Warsh, about legal action in the event of a refusal to cut rates, as well as comments from the Treasury Secretary about a possible criminal investigation, represent unprecedented political pressure. Such actions undermine investor confidence in the US's institutional stability and in the dollar as an asset protected from political interference.

Data from the US released last week indicated signs of weakness in the labor market and supported market sentiment in favor of further policy easing by the Federal Reserve. Expectations of monetary policy easing remain a key driver of the gold market. Lower interest rates typically increase the appeal of non-yielding assets, such as gold. According to market expectations, investors are pricing in the likelihood of several rate cuts throughout the year.

Weakening of the US Dollar

The decline in the dollar index creates favorable conditions for gold's growth, as the metal becomes cheaper for holders of other currencies. Pressure on the USD is increasing amid uncertainty in economic policy and expectations for key macroeconomic data.

Geopolitics and Demand for Safe-Haven Assets

Interest in gold remains steady due to global economic risks and the process of dedollarization. However, the decline in geopolitical tensions and the rise of stock markets temporarily limit demand for safe-haven assets.

Purchases of Gold by Central Banks

The People's Bank of China continues to increase its gold reserves actively, sustaining long-term demand. According to the Chinese central bank, the authorities have been expanding gold reserves for 15 consecutive months, adding 40,000 troy ounces in January of this year. This factor remains one of the keys to sustaining an upward trend.

However, there are obstacles to a sustained rise in gold prices:

- Increased optimism in global equity markets. Overall positive trends in the stock market contribute to capital outflows from traditional safe-haven assets, including gold.

- Heightened uncertainty around the US economy. Traders are awaiting the publication of key US economic indicators, including the anticipated NFP report (on Wednesday) and inflation data (on Friday), which are heightening volatility in the precious metals market. These macroeconomic publications could trigger gold's exit from the current consolidation phase.

Furthermore, the gold market will be influenced in the near future by comments from Federal Reserve representatives. Speeches by Waller, Miran, and Bostic.

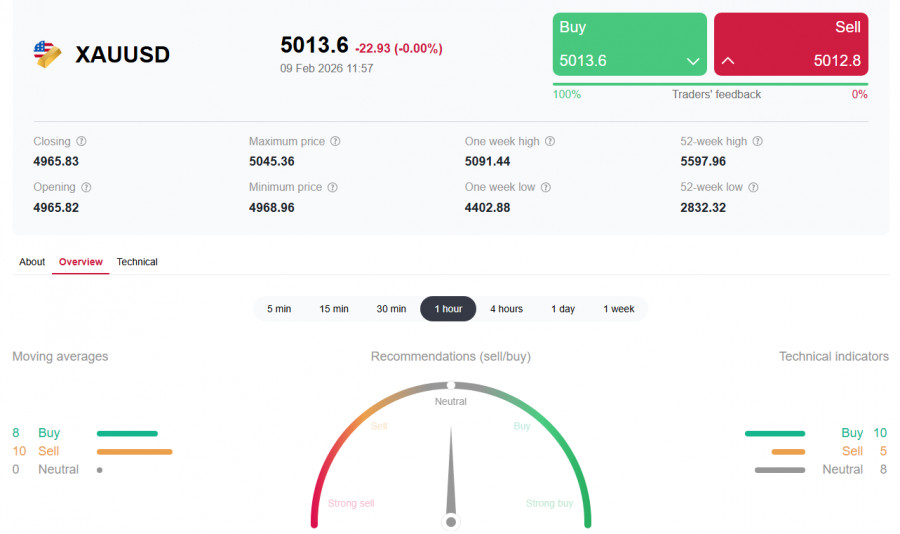

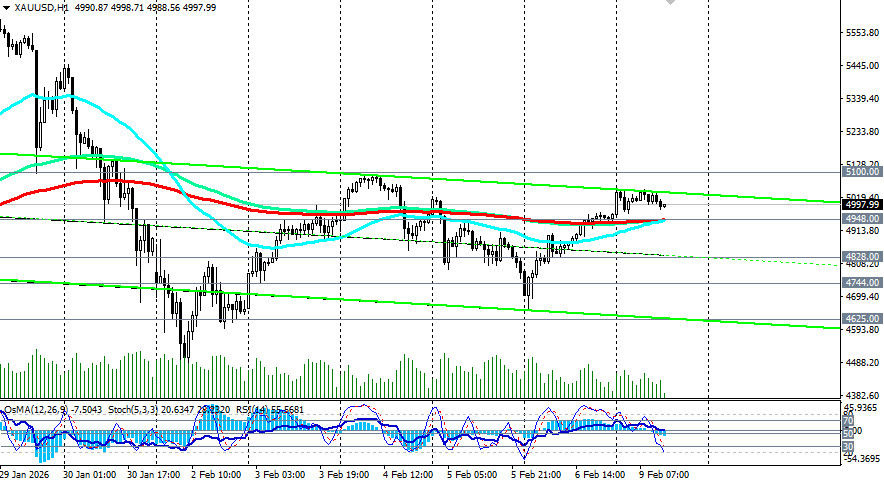

Technical Picture

Late on Friday, yet again breaching an important short-term resistance level of 4948.00 (EMA200 on the 1-hour XAU/USD chart), the price is once again attempting to resume its upward momentum in the first half of Monday. Before the start of the American session, XAU/USD was trading just above the "round" mark of 5000.00, having updated the day's intraday and 3-day high near 5046.00.

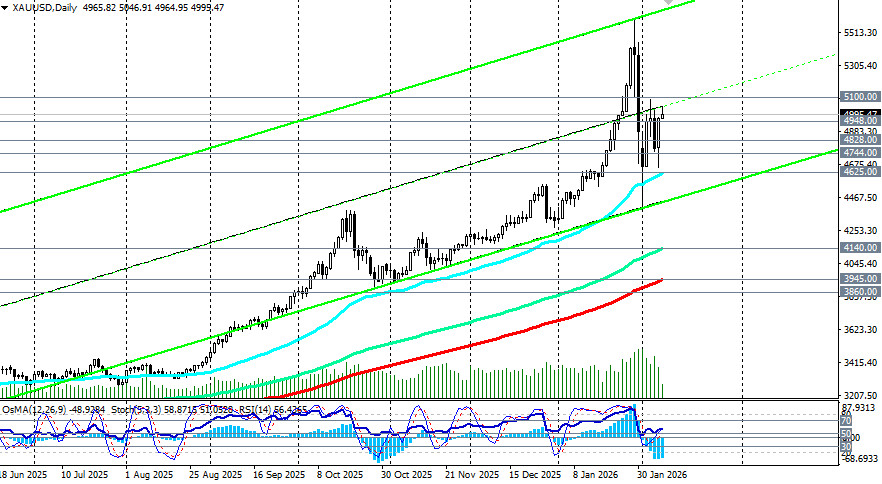

Overall, the pair continues to trade in a bullish market zone, short-term – above 5000.00 - 4948.00, medium-term – above 4000.00 – 3860.00, and long-term – above the zone of 3000.00 – 2800.00.

At the same time, technical indicators (in this case, OsMA, RSI, and Stochastic) on long-term time frames (weekly and monthly) remain in favor of buyers but provide mixed signals on short-term time frames (1- and 4-hour). The Relative Strength Index (RSI) is in the 60-65 range, which is considered favorable for bulls but not strong enough to sustain buying.

Base Scenario

If the dollar continues to weaken and expectations for rate cuts strengthen, gold may resume its growth. A consolidation above the technical levels of 5050.00 and 5100.00 will signal an increase in buying.

Alternative Scenario

In the face of strong US economic data and rising bond yields, pressure on gold may intensify, leading to a corrective decline.

Medium-Term Prospects

On a broader horizon, gold maintains growth potential due to the long-term trend of dedollarization, central bank purchases, expectations of monetary policy easing, and global economic uncertainty. However, the market remains sensitive to news and macroeconomic data.

Conclusion

Gold is in a consolidation phase after strong growth, holding at high levels. The weakening dollar provides support for the metal, expectations of rate cuts, and sustained demand from central banks. In the near future, the key factor will be US macroeconomic data, which may set the direction for XAU/USD in the coming weeks. Overall, the fundamental picture remains moderately positive, but for a new strong impulse, the market requires an additional trigger.

The current situation is characterized by stability; however, a breakthrough of the broad resistance zone of 5050.00 – 5150.00 will allow the price to make the next significant upward move. Investors are advised to exercise caution, given the approach of important macroeconomic releases (the NFP report on Wednesday at 13:30 GMT and CPI inflation data on Friday, also at 13:30 GMT), as well as potential further changes in market conditions.